Lender processing is one of the most critical components of the modern financial ecosystem, serving as the structured system through which loan applications are evaluated, verified, approved, and ultimately funded. Whether a borrower is applying for a mortgage, personal loan, business loan, or line of credit, determines not only if the loan will be approved but also how quickly, accurately, and securely the decision is made. In today’s competitive lending environment, where borrowers expect rapid decisions and regulators demand strict compliance, efficient lender processing has become a strategic advantage rather than a back-office function.

At its core, combines human expertise, automated systems, regulatory checks, and data analysis to assess borrower eligibility and manage risk. As financial institutions continue to adopt digital tools and artificial intelligence, has evolved into a sophisticated operation that balances speed with accuracy while maintaining compliance with complex financial regulations. Understanding lender processing is essential for borrowers, lenders, and financial professionals alike, as it directly impacts loan outcomes, customer satisfaction, and institutional profitability.

What Is Lender Processing?

Lender processing refers to the structured sequence of steps a lender follows after receiving a loan application, transforming raw borrower data into an informed lending decision. This process begins once an application is submitted and continues through verification, underwriting, approval, and loan disbursement. Unlike simple data review, involves layered evaluations that ensure the borrower meets eligibility requirements, income claims are accurate, credit risk is acceptable, and regulatory standards are fully satisfied.

Modern lender processing integrates manual review with automated decision-making systems that analyze credit scores, employment records, bank statements, debt-to-income ratios, and asset documentation. These systems help lenders reduce human error while improving processing speed. However, human oversight remains essential, particularly for complex loan scenarios, high-value transactions, or cases involving non-standard income sources. The goal of is to protect both the borrower and the lender by ensuring fair, accurate, and responsible lending decisions.

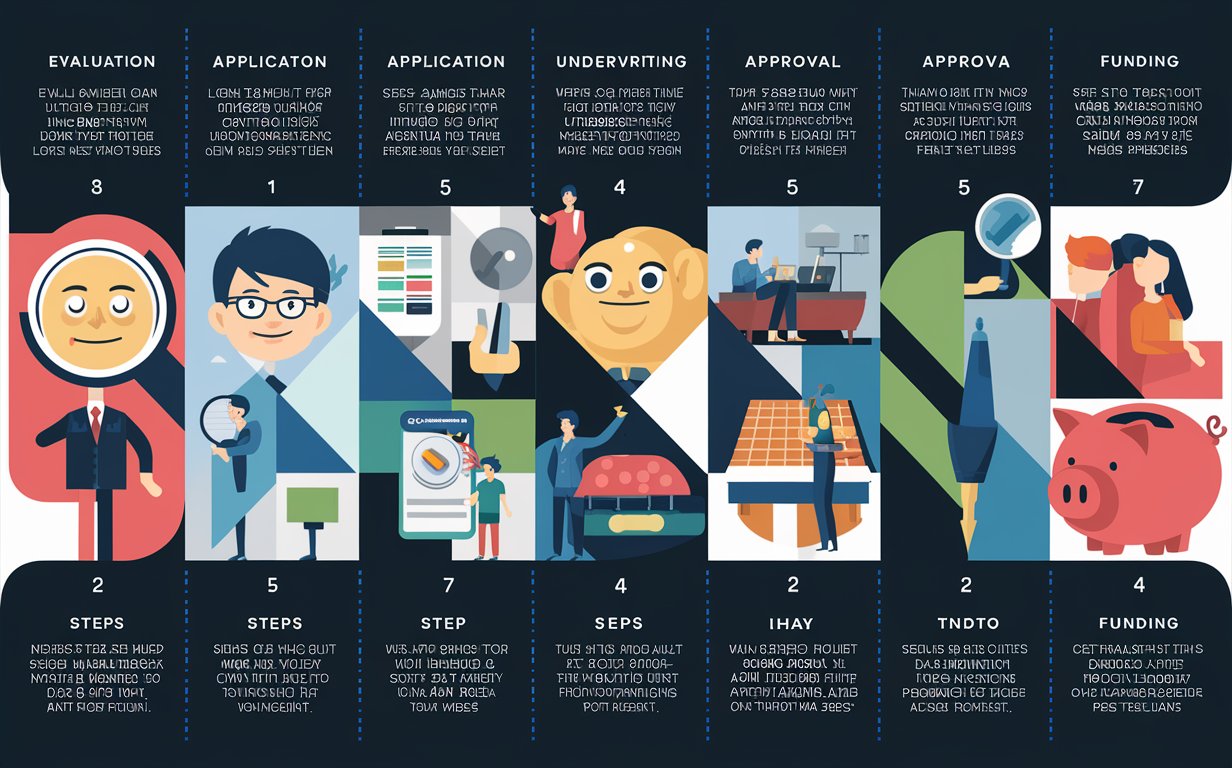

Key Stages in the Lender Processing Workflow

The lender processing workflow typically begins with application intake, where borrower information is collected through digital or paper forms. During this stage, lenders ensure that all required documentation has been submitted, including identification, income verification, credit authorization, and asset disclosures. Incomplete or inaccurate submissions can significantly delay , making this stage crucial for efficiency.

Following intake, the verification stage confirms the authenticity of borrower information. Employment verification, income validation, credit history review, and identity checks are conducted to ensure accuracy and reduce fraud risk. After verification, underwriting evaluates the borrower’s overall financial profile using predefined risk models and lending guidelines. Underwriters assess creditworthiness, repayment capacity, and loan suitability before issuing an approval, conditional approval, or denial. The final stage of lender processing is loan closing and disbursement, where legal documents are executed, funds are released, and the loan becomes active.

The Role of Technology in Lender Processing

Technology has transformed lender processing by automating repetitive tasks and enabling data-driven decision-making. Loan origination systems (LOS), automated underwriting engines, and document management platforms now form the backbone of efficient operations. These technologies allow lenders to process higher loan volumes while maintaining consistency and regulatory compliance.

Artificial intelligence and machine learning are increasingly used in lender processing to analyze borrower behavior, predict default risk, and flag anomalies that may indicate fraud. Optical character recognition (OCR) accelerates document review, while API integrations allow real-time verification of income and assets. By leveraging technology, lenders can reduce turnaround times, improve approval accuracy, and enhance the borrower experience without sacrificing risk controls.

Why Lender Processing Is Critical for Risk Management

Effective lender processing plays a central role in managing financial risk and maintaining portfolio health. Poorly executed processing can result in loan defaults, regulatory penalties, and reputational damage. By thoroughly evaluating borrower data and applying consistent underwriting standards, lenders minimize exposure to high-risk loans while ensuring fair access to credit.

Risk management within lender processing also includes compliance with anti-money laundering (AML), know-your-customer (KYC), and consumer protection regulations. These safeguards protect lenders from legal exposure and ensure ethical lending practices. In an era of increasing regulatory scrutiny, robust lender processing systems are essential for long-term operational stability.

Lender Processing and Borrower Experience

From the borrower’s perspective, lender processing directly influences satisfaction and trust. Long processing times, unclear requirements, and repeated documentation requests can frustrate applicants and lead to abandoned applications. Conversely, transparent and efficient lender processing builds confidence and encourages repeat business.

Modern lenders focus on streamlining communication, providing real-time status updates, and minimizing manual paperwork to improve the borrower experience. By combining automation with personalized support, can be both efficient and customer-centric, benefiting all parties involved.

Conclusion

Lender processing is the foundation upon which responsible lending is built, connecting borrower information, regulatory requirements, and financial risk assessment into a cohesive decision-making framework. As lending continues to evolve through digital innovation and regulatory complexity, will remain a defining factor in loan quality, operational efficiency, and customer satisfaction. Institutions that invest in strong systems gain a competitive advantage by delivering faster decisions, reduced risk, and improved borrower trust.

Understanding empowers borrowers to submit accurate applications and helps financial professionals optimize their workflows. In a financial landscape where precision and speed are equally important, lender processing stands as a critical pillar of modern lending success.

Frequently Asked Questions (FAQ)

What does lender processing mean in simple terms?

Lender processing is the step-by-step system lenders use to review loan applications, verify borrower information, assess risk, and decide whether to approve or deny a loan.

How long does lender processing usually take?

The duration of lender processing varies by loan type and lender, ranging from a few hours for automated personal loans to several weeks for complex mortgages or business loans.

What documents are required for lender processing?

Common documents include proof of income, identification, credit authorization, bank statements, tax returns, and employment verification, depending on the loan type.

Can lender processing be denied after pre-approval?

Yes, lender processing can result in denial if new information emerges, documentation cannot be verified, or the borrower’s financial situation changes.

How can borrowers speed up lender processing?

Borrowers can improve processing speed by submitting complete and accurate documentation, responding promptly to lender requests, and maintaining stable financial conditions during the review period.